As of early January 2020, Hawaii and Utah were the only two states in the USA that had placed a blanket ban on all forms of gambling. However, on the 25th of January, two senators proposed a legislative bill that would see gambling allowed. They hoped that the gambling industry’s taxes would see the State fund necessary programs in their jurisdiction. The two bills – Senate Bill 850 and Senate Bill 2669 would allow the establishment of a regulatory body, Hawaii Lottery and Gaming Corporation, that would oversee all gambling activity in the State. The gambling bills would include placing wagers on games involving chance such as sweepstakes and lotteries.

Hawaii loses millions in every casino they reject

Tourism is Hawaii’s primary source of revenue, generating over 2 billion dollars in 2019 alone. However, Hawaii loses 20 to 40 million dollars a year for every rejected casino. While this is a drop in the bucket, the numbers could easily double, considering only a 15 percent tax was calculated. A decade ago, the House Judiciary Committee and the House Economic Revitalization and Business Committee voted to legalize gambling, but the legislature rejected it.

The gaming draft proposal yet to pass

On Tuesday, the Hawaiian Homes Commission voted to allow a draft bill supporting a Casino in Kapolei, Oʻahu. In a tightly contested vote, 5-4, the commission approved limited gaming in a resort that was to be established in Kapolei, Oʻahu. With dwindling revenues due to covid19, the State has been cash strapped with programs facing limited budgets. While it is not yet official, the ball now falls at the Attorney General’s office, and the Department of Budget &Finance, before heading to the Governor’s office. Suppose the Governor adds the draft bill to his packet, then it would be up to the State’s legislature to approve the bill. But what if the Governor declines to include it in his packet? Well, it would be up to the department to seek a legislator who would introduce it to the house for debate.

The proposal is facing a tough challenge at the legislature

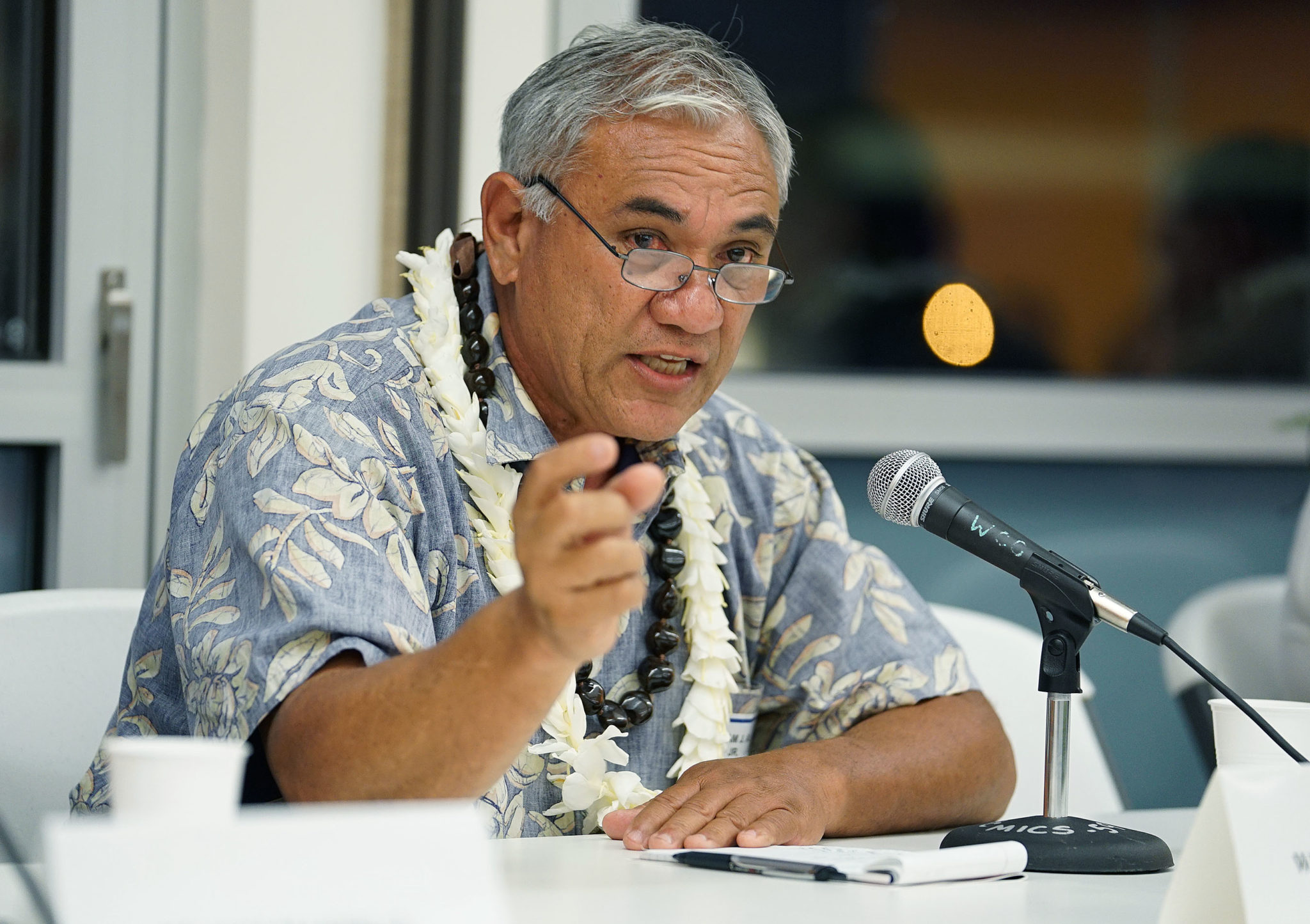

The DHHL proposal seems unlikely. Hardliners such as Senate President Ron Kouchi are expected to reject the bill. According to him, if gambling were legalized, native Hawaiians would be shortchanged if native American tribes are allowed to open casinos. This would see the State lose millions in taxes. However, this hardline approach is addressed by the U.S. Department of the Interior. For tribal gaming, Casinos would be required to have compacts with native tribes and other regulative agencies.

Nonetheless, the proposal would see the DHHL become the sole beneficiary of the gaming operation tax by leasing land in the settlement. This means that DHHL would benefit from collecting taxes from the licensee and also direct tax collection of 80 percent in gross gaming revenues. The draft proposal will establish a Hawaii Gaming Commission that will oversee all gambling activities. The proposal will also determine licensing fees and the criteria to which a casino will be awarded a license. It will also establish a tax on all wagers and also create a State Gaming Fund.

The fund will see the government invest in programs that address crime, gambling addictions, and other social-economic issues.