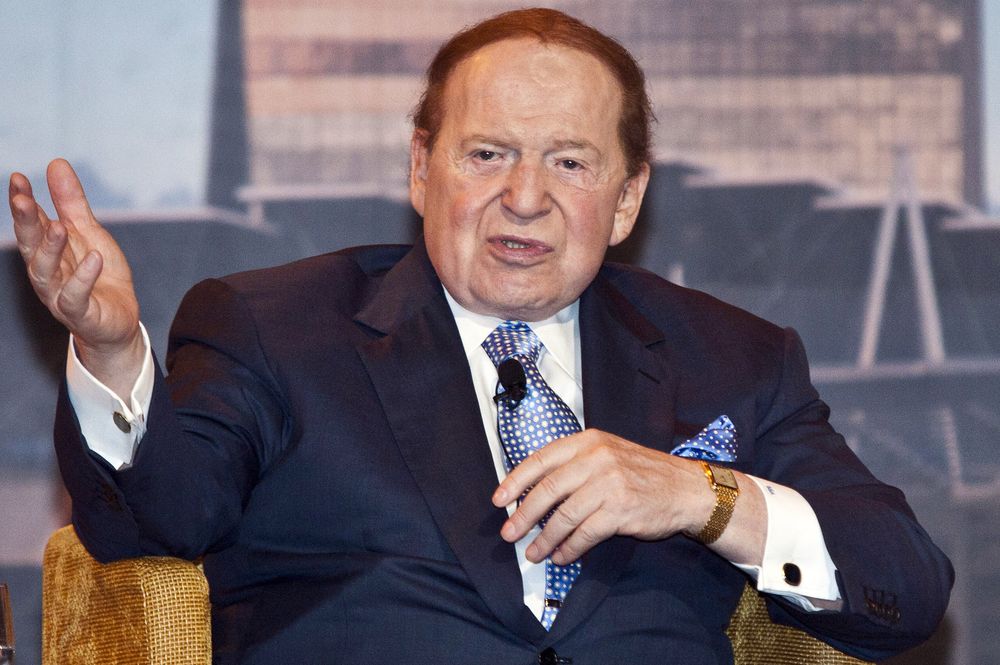

83-year old billionaire Sheldon Adelson has hired experts to exploit his options for exiting the USA gambling industry. Among the likely prospects for the tycoon is to sell his Las Vegas assets that include but aren’t limited to the Sands Expo Convention Center and the iconic Venetian Resort Las Vegas. Adelson is reportedly planning to shift his business to Asia, where gambling is gaining popularity in the mainstream.

The Asian market is snowballing thanks to young Chinese punters who travel out of the country to as far as Australia just to gamble. If Adelson’s exit plan materializes, the proceeds of the $6 billion Las Vegas property would be merged with Sands’ $5.4 billion adjusted property EBITDA in Asia. The $5.4 billion is about 90% of what could be accounted for before the COVID-19 pandemic struck.

Close confidants hinted that Adelson will still retain the headquarters of his companies in Las Vegas to oversee the old family business, Las Vegas Review-Journal. Some of the proceeds might also be channeled towards the opening of a New York casino resort, which remains one of Adelson’s unaccomplished goals in life.

Bank of America Is Doubting Adelson’s Exit

The Bank of America didn’t hesitate to express its doubts on whether Adelson will manage to liquidate his Las Vegas assets amidst the pandemic and a dwindling economy. There is a paucity of potential buyers since most investors in the region have limited access to capital market finances.

The Asian-America Gambling Entity

Sands’ existence dates back to 1989 and has since grown into the largest casino company in the world. Among Sheldon’s business partners who contributed to Sands’ inception include Jordan Shapiro and Richard Katzeff when they bought the then Sands Hotel.

While Sands has a strong presence in the USA, a vast of its revenues emanate from the Asian market. In 2019, CNN Business reported that Sands’ USA market share accounted for only 13% of its annual revenues. The biggest revenue generator for Sands is the Macau operations that accounts for nearly 60% of yearly revenues.

How Does Sheldon’s Exit Affect the American Online Gambling Industry?

Besides infrastructure, Sands’ exit could also sway the USA politics surrounding online gambling, and its legalization. Sheldon is known to throw his money weight behind politicians who support his ideas. This saw him spending up to $75 million to run campaigns against Joe Biden just to prove his aversions towards online gambling. Sheldon also financed Sen. Lindsey Graham’s campaign to echo his anti-online gambling sentiments.

Sheldon’s exit could also see the fall of various anti-online initiatives such as the Coalition to Stop Internet Gambling (CSIG), which has been fighting online poker since 2013. Therefore, online gambling legalization will likely take a different course in the coming years across many States.

Sheldon Hates Technology

In 2014, The Verge, through a controversial live article exposed where Sheldon drew his anti-online gambling views and why he never sees it as the next biggest thing in the Casino industry. According to the same, Sheldon hates email and doesn’t send texts to anyone. In fact, some online magazines later accused him of starting an “Internet Jihad” by discouraging people to shy away from the internet.